‘It’s gutting’: Jackson County businesses hit with high property tax assessments

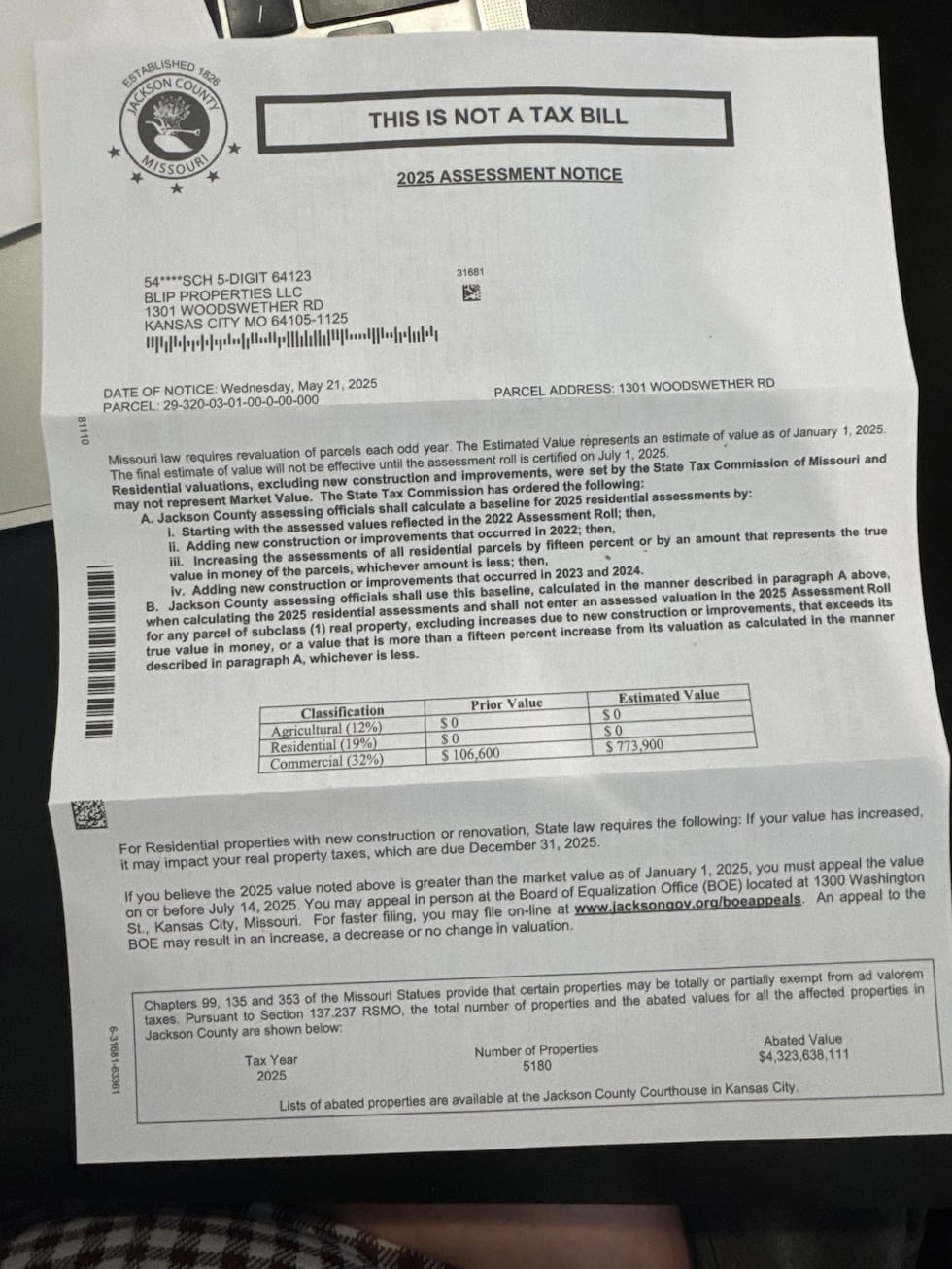

KANSAS CITY, Mo. (KCTV) - This week, business and property owners across Jackson County were shocked when they received their 2025 commercial property tax assessments. Blip owner Ian Davis showed KCTV5 the 626% increase in his coffee shop’s property assessment: from $106,600 to $773,900.

“It’s terrifying,” said Davis. “It’s disappointing. It’s gutting. We’re definitely not the highest number we’ve heard. The highest percent increase I heard is over 1500% year over year on property tax increases.”

The coffee shop has been a staple in the West Bottoms for nearly 12 years. Coffee is a ion for Davis. He says his shop has become a ‘third place’ for many, but its it’s been hard the last few years.

“We navigated COVID, the cost of goods are up, insurance is up, Evergy has raised our rates, the gas company has raised their rates,” said Davis. “Everything has been pretty difficult. For small businesses, for local ownership of property in Kansas City this is pretty devastating.”

The latest tax assessment has Davis questioning the county’s motives.

“They are being clear about what businesses they want to have, and they are being clear about who they want to own property in Jackson County,” said Davis. “I think they know exactly what they’re doing. I think Jackson County is making it clear that they want the biggest checkbook to come into their county and develop and put businesses here that are more aligned with the way Jackson County wants to do business. Unfortunately, I don’t think that is most of the businesses that they currently have here.”

He adds it’s not just small property owners that will feel the impact.

“This is affecting every commercial property owner in Jackson County,” said Davis. “This is also going to affect every tenant of a commercial property in the county. Every business that operates in a physical location will see their rent go up. Most commercial leases have a ‘ through’; when taxes go up, your rent goes up. It doesn’t have to be renegotiated, doesn’t get a pause. If you’re a commercial tenant in Jackson County you could very well see an increase to your rent starting in July.”

Davis says he’s spoken with dozens of property owners throughout Jackson County since the assessments went out. They were also discussed at the latest Historic West Bottoms Association meeting; as the association’s vice president, he reached out to Jackson County legislators.

On Friday afternoon, a meeting was held to discuss what business and property owners could do. Jackson County Legislator Manny Abarca was the only legislator who attended. He says people began reaching out soon after assessments were sent out.

“They are saying this is astronomical,” said Abarca. “I couldn’t imagine being a business owner, trying to be successful, trying to add value to our community and then this type of thing happens. It’s foundation cracking. What do you do now and where do we go from here?”

He acknowledged many business and property owners are likely feeling angry, scared, and confused.

“That’s very easy to feel,” said Abarca. “It’s very easy to feel they don’t want residential people here either. The impact that Jackson County is having on day-to-day taxpayers, business owners now, you can’t have a functioning county if you don’t have people living in it and contributing. It’s maniacal to think these types of impacts weren’t considered in the outcomes of where we see Jackson County 10 years from now. There is no Jackson County 10 years from now if we continue to do this with taxation.”

His office ed out a step-by-step guide of the appeals process at the meeting:

1. Submit your appeal online, by mail, or in person. You will need your assessment notice or parcel number, a written appeal letter explaining your position, and ing documentation. the Board of Equalization by emailing [email protected] or by calling 816-881-3309

2. To justify a change in your assessed value, submit relevant evidence such as:

-a certified appraisal (not from a real estate agent)

-settlement statement or sales contract

-comparable sales of nearby properties

-repair estimates or costs

-photos showing property condition (interior and exterior)

-rent rolls, leases, income and expense statements (last three years)

-depreciation schedules (last three years)

Note: Redact Social Security or Employer ID numbers. Evidence presented on electronic devices will not be accepted.

3. What happens after you file an appeal.

You may choose from the following appeal types:

-Formal hearing - appear before the Board

-Waiver - Board reviews documents without a hearing

-Advancement - skip BOE and appeal directly to the Missouri State Tax Commission

At your hearing (virtual or in-person):

-Hearings are called in docket order

-All witnesses are sworn in

-You and the Assessment Department present your opinions of value

-Evidence must be concise and factual

-The Board does not follow formal legal evidence rules

The Board will then determine the property’s market value as of Jan. 1, 2025. if major changes occured between Jan. 1, 2025 and Jan. 1, 2026, the phsyical condition as of Jan. 1, 2024 will be used for evaluation.

The Board may increase, decrease, or make no changes to your value. Results are voted on digitally. You may request the outcome by email or mail. The Board will not generate or provide copies.

If you disagree with the BOE decision, you may appeal to the Missouri State Tax Commission (STC) no later than Sep. 30, 2025, or within 30 days of the decision notice - whichever is later.

Abarca added he’s working to push back the appeals deadline past July.

“We’ve drafted legislation to move the appeals deadline back to more equalization, I think to August 15th,” said Abarca. “We have written legislation to try and create a cap at the county level, which we have the ability to do, both legislatively with 6 votes and/or the Executive by himself. If that doesn’t work, we jump to the next step of state legislation, gubernatorial action because the legislature is out of session. It’s going to have to be gubernatorial executive order right now.”

For now, commercial property owners in Jackson County have until July 14 to appeal the value assessment or their property taxes are due Dec. 31, 2025.

Abarca says another meeting for business and property owners is being planned.

Copyright 2025 KCTV. All rights reserved.